Rumored Buzz on Pvm Accounting

Rumored Buzz on Pvm Accounting

Blog Article

Top Guidelines Of Pvm Accounting

Table of ContentsWhat Does Pvm Accounting Mean?The Buzz on Pvm AccountingUnknown Facts About Pvm AccountingPvm Accounting Fundamentals ExplainedNot known Details About Pvm Accounting The Only Guide for Pvm Accounting

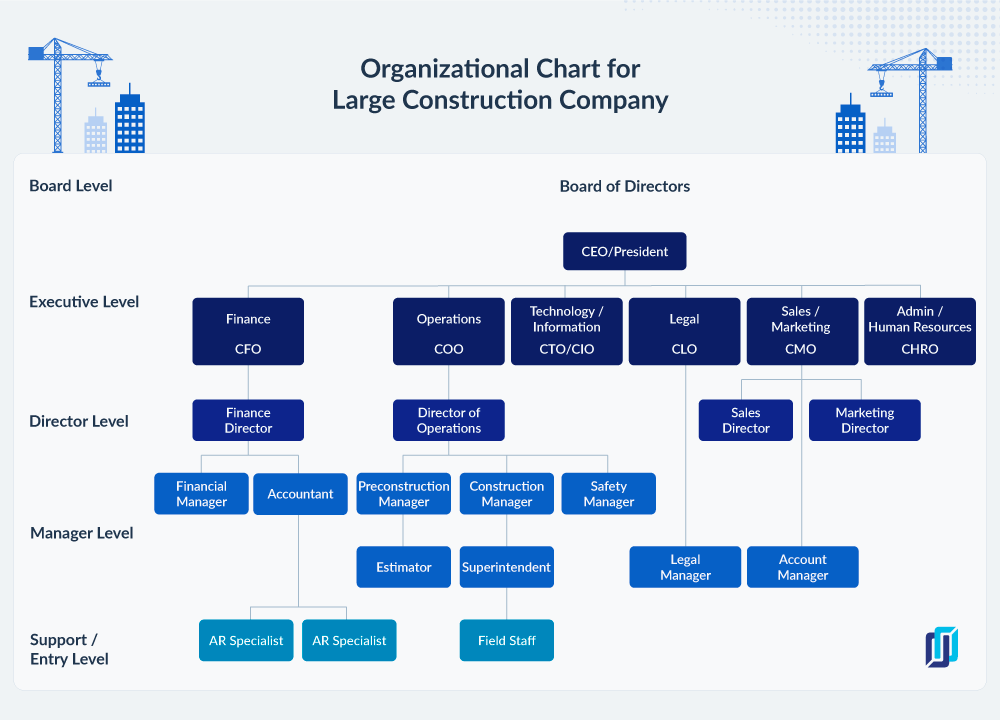

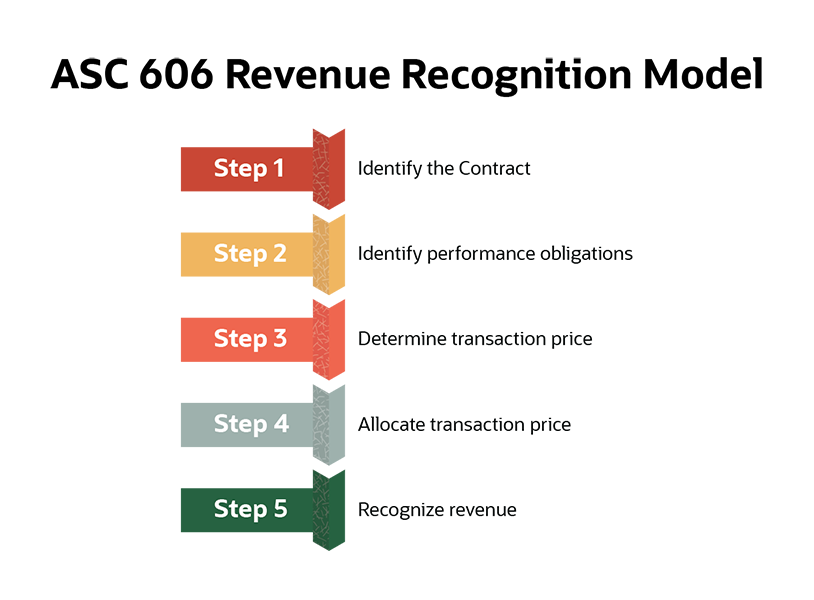

Oversee and manage the development and authorization of all project-related invoicings to customers to promote excellent communication and stay clear of issues. construction accounting. Make certain that ideal reports and documents are submitted to and are updated with the internal revenue service. Make sure that the bookkeeping procedure adheres to the regulation. Apply required building and construction accounting requirements and procedures to the recording and coverage of construction activity.Communicate with different financing firms (i.e. Title Firm, Escrow Business) pertaining to the pay application procedure and needs required for repayment. Help with executing and maintaining internal financial controls and treatments.

The above declarations are meant to explain the general nature and level of job being performed by individuals designated to this classification. They are not to be understood as an exhaustive list of duties, obligations, and abilities needed. Personnel might be required to do tasks beyond their regular duties every now and then, as needed.

What Does Pvm Accounting Mean?

You will certainly help sustain the Accel group to make certain shipment of effective in a timely manner, on budget, jobs. Accel is looking for a Building Accountant for the Chicago Office. The Building and construction Accountant does a variety of accountancy, insurance coverage conformity, and project management. Functions both separately and within details divisions to preserve economic records and make specific that all documents are maintained current.

Principal responsibilities consist of, however are not limited to, dealing with all accounting functions of the firm in a timely and accurate way and giving reports and schedules to the business's certified public accountant Company in the prep work of all economic declarations. Guarantees that all bookkeeping treatments and features are handled precisely. In charge of all economic documents, payroll, banking and daily operation of the bookkeeping feature.

Prepares bi-weekly test balance records. Functions with Job Managers to prepare and upload all regular monthly billings. Processes and issues all accounts payable and subcontractor payments. Creates monthly recaps for Employees Payment and General Obligation insurance coverage costs. Produces regular monthly Job Price to Date reports and dealing with PMs to resolve with Job Supervisors' spending plans for each project.

How Pvm Accounting can Save You Time, Stress, and Money.

Effectiveness in Sage 300 Building And Construction and Genuine Estate (previously Sage Timberline Workplace) and Procore building and construction management software application an and also. https://disqus.com/by/leonelcenteno/about/. Must additionally be proficient in other computer software program systems for the preparation of reports, spread sheets and other audit analysis that may be called for by monitoring. Clean-up bookkeeping. Must possess strong business abilities and capacity to prioritize

They are the monetary custodians that ensure that building jobs continue to be on budget, follow tax obligation regulations, and maintain monetary openness. Building and construction accountants are not just number crunchers; they are calculated companions in the construction process. Their primary function is to take care of the economic facets of construction projects, guaranteeing that resources are designated successfully and economic risks are decreased.

Excitement About Pvm Accounting

By keeping a limited hold on job finances, accountants help protect against overspending and monetary setbacks. Budgeting is a cornerstone of effective building tasks, and building accountants are instrumental in this respect.

Browsing the facility internet of tax regulations in the construction industry can be challenging. Building accounting professionals are well-versed in these laws and ensure that the job complies with all tax obligation demands. This consists of managing pay-roll taxes, sales taxes, and any various other tax obligations certain to building and construction. To succeed in the role of a building accountant, individuals require a strong academic foundation in accounting and financing.

Additionally, qualifications such as Licensed Public Accountant (CPA) or Qualified Building And Construction Market Financial Professional (CCIFP) are highly pertained to in the market. Building projects often entail tight target dates, transforming policies, and unexpected expenditures.

Some Ideas on Pvm Accounting You Should Know

Expert certifications like CPA or CCIFP are additionally highly suggested to demonstrate competence in building accountancy. Ans: Building accounting professionals develop and keep an eye on budget plans, identifying cost-saving opportunities and making certain that the task remains within budget plan. They also track expenditures and projection financial needs to avoid overspending. Ans: Yes, construction accounting professionals manage tax obligation compliance for building projects.

Intro to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies have to make hard choices amongst several financial choices, like bidding process on one job over another, picking financing for materials or tools, or setting a project's revenue margin. Construction is an infamously unpredictable industry with a high failure rate, slow-moving time to settlement, and inconsistent cash flow.

Common manufacturerConstruction organization Process-based. Production entails duplicated procedures with conveniently recognizable expenses. Project-based. Production calls for different procedures, materials, and tools with varying prices. Taken care of place. Production or production takes place in a single (or a number of) controlled places. Decentralized. Each project happens in a new place with differing site problems and unique challenges.

The Best Strategy To Use For Pvm Accounting

Long-lasting partnerships with vendors relieve settlements and boost performance. Irregular. Constant usage of various specialized contractors and providers impacts effectiveness and money flow. No retainage. Payment arrives in complete or with normal payments for the complete agreement quantity. Retainage. Some part of repayment may be withheld until task conclusion also when the service provider's job is ended up.

Normal manufacturing and short-term agreements cause navigate to these guys workable capital cycles. Uneven. Retainage, sluggish payments, and high ahead of time expenses result in long, irregular cash money flow cycles - Clean-up accounting. While conventional producers have the advantage of regulated settings and maximized manufacturing procedures, building and construction firms have to regularly adapt to every brand-new job. Also rather repeatable projects call for modifications as a result of site problems and other aspects.

Report this page